WAGE TAX Meaning and

Definition

-

Wage tax refers to a type of tax that is levied on an individual's earned income, which includes wages, salaries, and other forms of compensation received from an employer. It is commonly imposed by the government at various levels, such as federal, state, or local jurisdictions, as a means to generate revenue for essential public services and expenditures.

The wage tax is typically calculated as a percentage of the individual's income, with the rate varying depending on the specific tax laws and regulations of the governing authority. This tax is often withheld from an employee's paycheck by their employer, who is then responsible for remitting the tax to the appropriate tax authority on behalf of the employee.

The purpose of implementing a wage tax is usually twofold. Firstly, it serves as a primary source of revenue for governments, enabling them to fund public initiatives such as infrastructure development, healthcare, education, and defense. Secondly, wage taxes also serve as a mechanism for maintaining income equality and distributing the burden of financing public services among the population based on their ability to pay.

Wage taxes may have certain exemptions or deductions that vary depending on the jurisdiction and the individual's specific circumstances. These exemptions or deductions are often aimed at providing relief for low-income earners or individuals with dependents, thereby reducing their overall tax liability and ensuring a fairer distribution of the tax burden.

Overall, wage tax is a crucial component of a nation's tax system, contributing to its fiscal stability, economic growth, and the provision of essential public goods and services.

Common Misspellings for WAGE TAX

- qage tax

- aage tax

- sage tax

- eage tax

- 3age tax

- 2age tax

- wzge tax

- wsge tax

- wwge tax

- wqge tax

- wafe tax

- wave tax

- wabe tax

- wahe tax

- waye tax

- wate tax

- wagw tax

- wags tax

- wagd tax

- wagr tax

Etymology of WAGE TAX

The word "wage tax" has a straightforward etymology that combines two separate terms: "wage" and "tax".

The term "wage" originated from the Old English word "wage" or "wæge", which meant "payment" or "compensation for services rendered". It is derived from the Proto-Germanic word "wagi-" which referred to "a pledge" or "a security". Over time, "wage" came to specifically represent the payment received by a worker for their labor.

On the other hand, the word "tax" came from the Middle English word "taxen" or "taxien", which were derived from the Old French word "taxer" or "tasser". This Old French term ultimately evolved from the Latin word "taxare", meaning "to assess" or "to appraise".

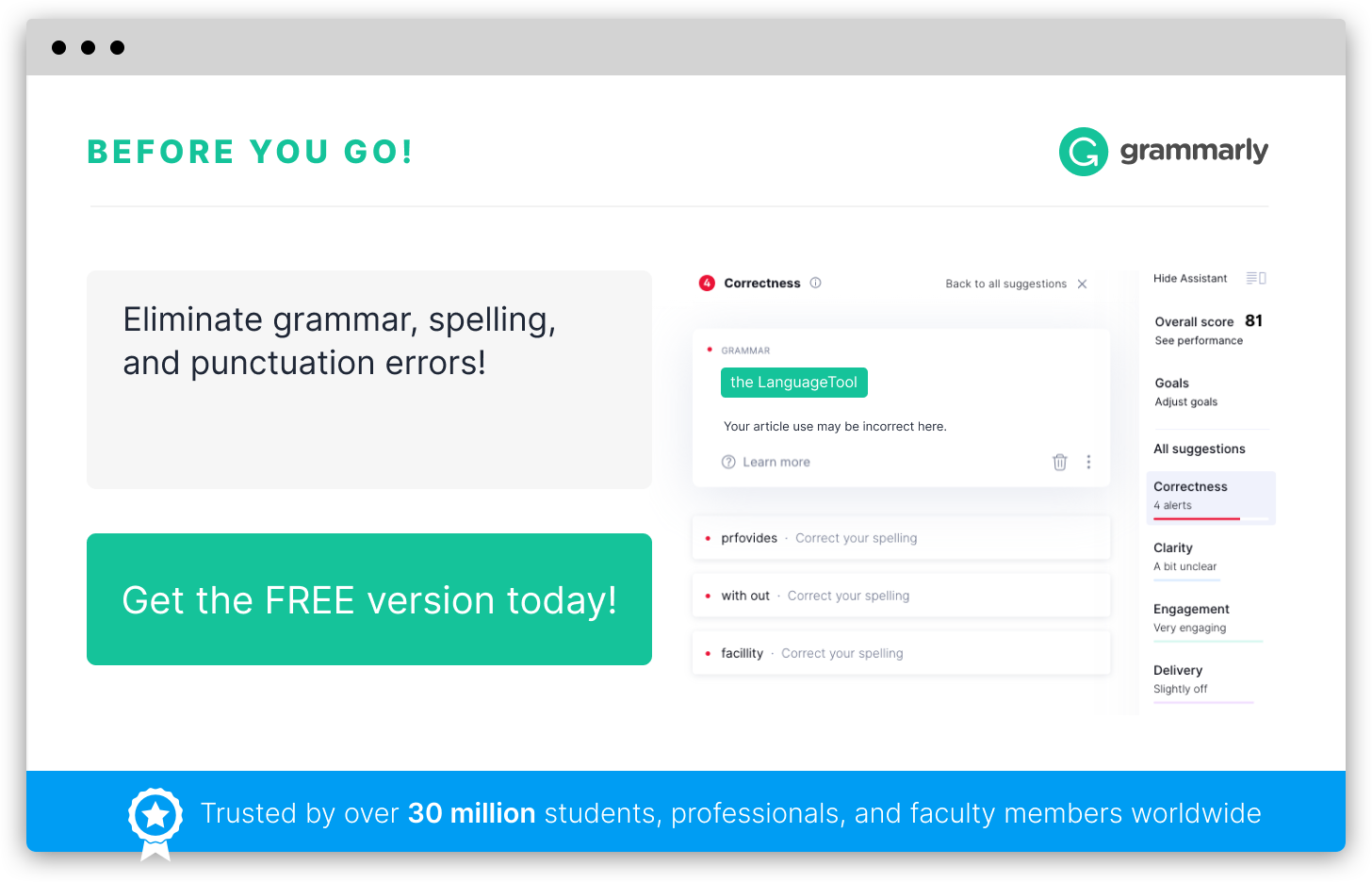

Infographic

Add the infographic to your website: