DIVIDEND COVER Meaning and

Definition

-

Dividend cover is a financial metric that measures the extent to which a company's earnings can support the dividend payments it distributes to shareholders. It serves as an essential tool for investors and analysts to evaluate the sustainability and risk associated with a company's dividend policy.

The dividend cover ratio is calculated by dividing a company's earnings, typically represented by the profit after tax or net income, by the total amount of dividends paid out to shareholders. For example, if a company's annual earnings are $10 million and it pays out $2 million in dividends, the dividend cover ratio would be 5.

A higher dividend cover ratio indicates that a company has more earnings available to cover its dividend obligations and is thus considered more financially stable. Conversely, a lower ratio suggests that the company's earnings might not be enough to support its dividends, increasing the risk of potential dividend cuts or the company's financial health being compromised.

Investors rely on the dividend cover ratio to assess the sustainability of a company's dividend payments. They typically seek companies with a healthy and consistent dividend cover ratio, indicating that the company generates enough profit to comfortably maintain its dividend policy. Furthermore, a high dividend cover ratio may attract dividend investors who prioritize steady income from their investment portfolios.

However, it is important to note that the ideal dividend cover ratio may vary between industries and companies. Some industries, such as utilities or consumer staples, tend to have higher dividend cover ratios due to their stable earnings, while other sectors with higher growth potential, such as technology or biotechnology, may have lower ratios as they reinvest more of their profits into future growth.

Common Misspellings for DIVIDEND COVER

- sividend cover

- xividend cover

- cividend cover

- fividend cover

- rividend cover

- eividend cover

- duvidend cover

- djvidend cover

- dkvidend cover

- dovidend cover

- d9vidend cover

- d8vidend cover

- dicidend cover

- dibidend cover

- digidend cover

- difidend cover

- divudend cover

- divjdend cover

- divkdend cover

- divodend cover

Etymology of DIVIDEND COVER

The term "dividend cover" does not have a specific etymology, as it is a compound word consisting of two separate words. However, we can explore the origins of each word individually.

1. Dividend: The word "dividend" comes from the Latin word "dividendum", which means "thing to be divided". It is derived from the Latin verb "dividere", meaning "to divide". In finance, a dividend refers to a payment made by a corporation to its shareholders, typically from its profits or reserves.

2. Cover: The word "cover" has Germanic origins and can be traced back to Old English. It is derived from the Old English word "cowerian", which means "to protect, defend, or shelter". In the context of finance, "cover" often refers to the ability of a company's profits to cover or fulfill its financial obligations, such as dividend payments.

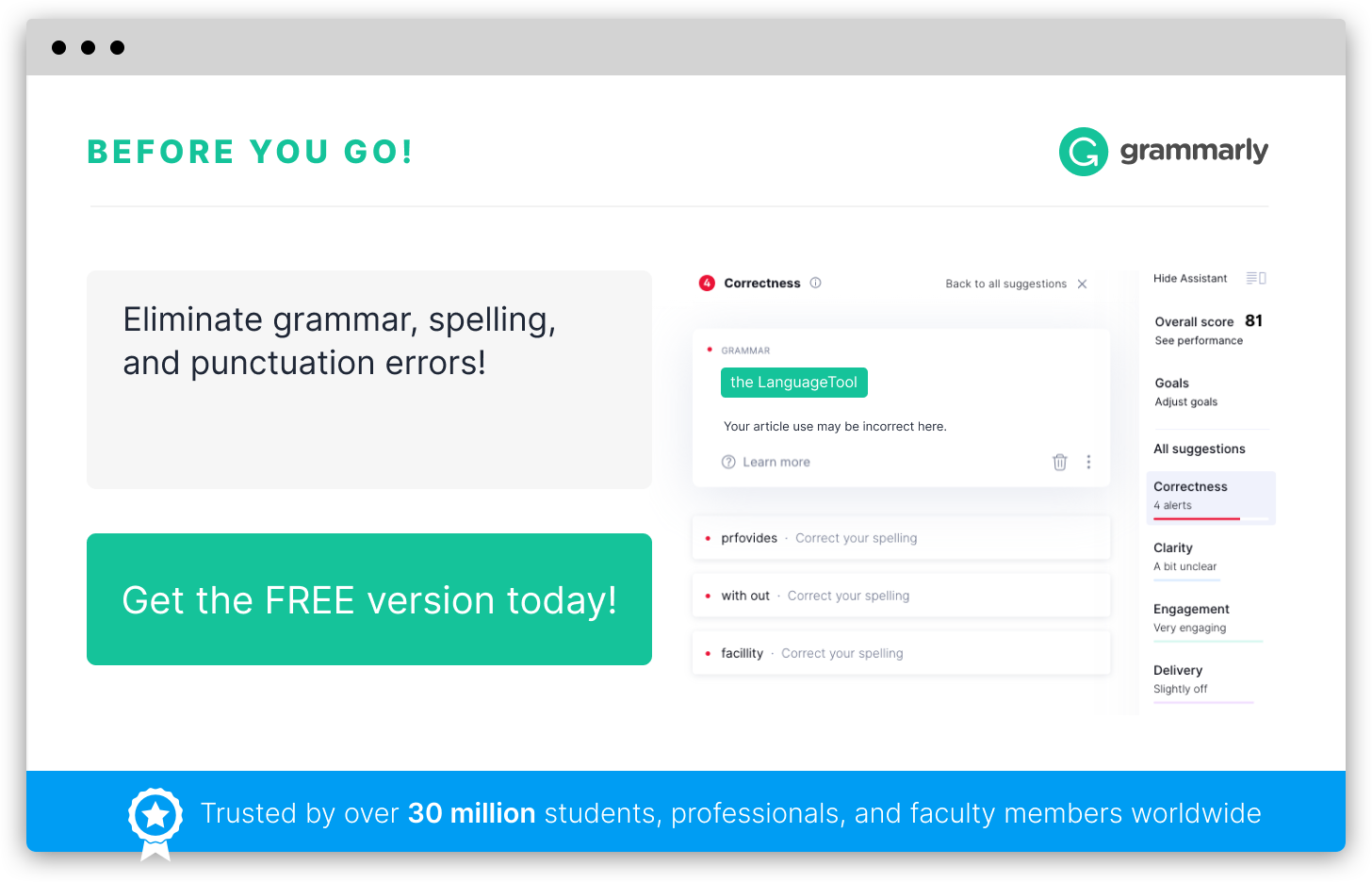

Infographic

Add the infographic to your website: