DEPRECIATION ALLOWANCE Meaning and

Definition

-

Depreciation allowance refers to a tax deduction provided to businesses for the gradual decrease in value or usefulness of their tangible assets over time. It is a method used to account for the wear and tear, obsolescence, or loss of value of assets such as machinery, buildings, vehicles, or equipment, as they are used in the production of goods or services.

The depreciation allowance allows businesses to account for the fact that their assets will eventually need to be replaced or upgraded due to factors like technological advancements or regular wear and tear. It recognizes that assets have a limited useful life and will gradually lose value over time.

The process of depreciation involves spreading out the cost of an asset over its estimated useful life rather than deducting the entire cost in the year of purchase. This is achieved by applying a set depreciation rate or formula to determine the annual deduction that can be claimed. By taking depreciation allowances, businesses are able to reduce their taxable income, thereby minimizing their tax liability.

This deduction encourages businesses to invest in new assets and replace outdated ones, as it helps them recover a portion of their investment each year. Depreciation allowance is an important tool for proper financial reporting and tax planning, ensuring that businesses accurately reflect the declining value of their assets and aid in their long-term sustainability and growth.

Common Misspellings for DEPRECIATION ALLOWANCE

- sepreciation allowance

- xepreciation allowance

- cepreciation allowance

- fepreciation allowance

- repreciation allowance

- eepreciation allowance

- dwpreciation allowance

- dspreciation allowance

- ddpreciation allowance

- drpreciation allowance

- d4preciation allowance

- d3preciation allowance

- deoreciation allowance

- delreciation allowance

- de-reciation allowance

- de0reciation allowance

- depeeciation allowance

- depdeciation allowance

- depfeciation allowance

Etymology of DEPRECIATION ALLOWANCE

The word "depreciation" comes from the Latin word "depretiare", which means "to lower the value of". It is derived from the combining form "de-" meaning "down" or "away", and "pretium" meaning "price" or "value".

The word "allowance" comes from the Old French word "aloiance", which ultimately comes from the Latin word "alliberare", meaning "to liberate" or "to set free". It originally referred to a grant of money or supplies.

In the context of "depreciation allowance", the term is used to describe the amount of money that a business can deduct from its taxable income to account for the decrease in value of an asset over time. The combination of these words signifies the concept of setting free or deducting the decrease in value of an asset.

Similar spelling word for DEPRECIATION ALLOWANCE

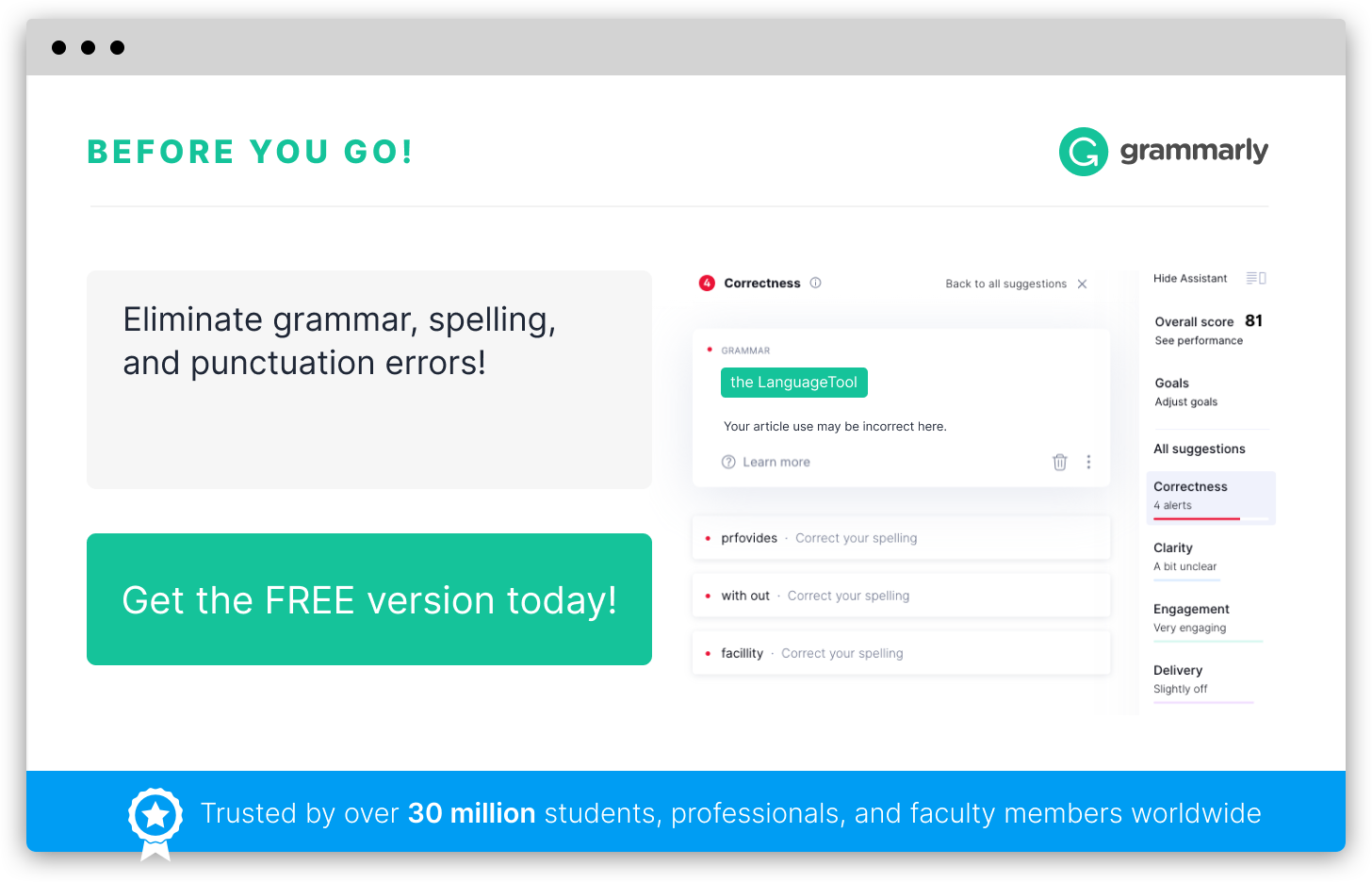

Infographic

Add the infographic to your website: